As the saying goes, getting rich is 20% of what you know and 80% of what you actually do. In building the Brightyear.io app, we created what we think is an excellent app to help anyone take action and get practice at setting and accomplishing good financial goals and habits (the 80%). However, if you don’t have a good understanding of what sound financial principles are in the first place (the 20%), you may only be getting yourself to the wrong place faster.

So, with that being said, I took some preparation before writing this blog post to go through and read many of the most popular books on finance out there and have compiled a list of 10 books that I consider to be the cream of the crop in learning how to better your own financial situation. Really, the list of great financial books obviously extends far beyond this list, however, I feel that reading any and all of these books will give you a great foundation in helping you to learn how to build and maintain wealth.

So without further adieu, let’s get started on 10 financial books I feel you need to read this year:

1. “Rich Dad Poor Dad” by Robert T. Kiyosaki

“Rich Dad Poor Dad” was the first financial book that really opened my eyes to the topic of personal finance and why I need to start taking it more seriously. The book is written by Robert T. Kiyosaki who does an excellent job explaining financial principles to someone just starting out. Throughout the book, Kiyosaki shares a story about all the important financial principles he learned from his friend’s rich Dad, and the financial pitfalls he learned to avoid from his own Dad. The following are a few of the key principles Kiyosaki teaches:

- The poor and the middle-class work for money. The rich have money work for them.

- It’s not how much money you make that matters. It’s how much money you keep.

- In all your purchases, buy assets, not liabilities. Assets in his definition are things that make you money and liabilities are things that take away money.

- The single most powerful money-making asset we all have is our mind.

2. “The Total Money Makeover” by Dave Ramsey.

Dave Ramsey is also very well known for his methods of finance to the lay individual and while I don’t think there really is a “one-size-fits-all” to personal finance, “The Total Money Makeover” in my opinion has been the best step-by-step approach I’ve seen to managing personal finances and growing wealth for the most amount of people. He sequentially lays out 7 “baby steps” that if diligently followed can take help just about anyone to improve their financial wellbeing:

- Save a $1,000 beginner emergency fund.

- Get out of debt using the debt snowball.

- Save a proper emergency fund that is 3-6 months of expenses.

- Invest 15% of household income for retirement.

- Save for children’s college.

- Pay off the home early.

- Build wealth and be generous.

If you don’t consider yourself a big book-reader, I’d recommend starting with this one. The book is relatively short and I feel like Ramsey really shares the principles in a fun and easy-to-understand kind of way.

3. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko.

Most of us have a certain image of what a millionaire looks like. Oftentimes when we see someone with a really nice house or fancy car, we immediately think that they own those things because they are rich. In their book, “The Millionaire Next Door,” Thomas J. Stanley and William D. Dank show us that the majority of millionaires actually live very modest and frugal lives. The data shows that the majority of self-made millionaires aren’t the kind of people you’d be able to pick out in a crowd or see based on the possessions they have. A millionaire most often becomes a millionaire by learning how to spend his earnings wisely.

Authors Stanley and Danko spent a good portion of their lives learning about and investigating the behaviors of the affluent. In preparation to write this book, they conducted one of the largest surveys of millionaires and they outline their findings throughout the duration of the book. They describe the behaviors and habits that millionaires often share and do so in a very factual, non-fluffed, matter-of-fact kind of way.

One of the main takeaways from this book is learning about the distinction between income and wealth. Your income is what you earn, but your wealth is what you accumulate, the latter is much more important. While you may think that earning more equates to greater wealth, this indeed isn’t how it goes as there are many high-income earners that still don’t get it right.

4. “The Richest Man In Babylon” by George Clason

“The Richest Man In Babylon” by George Clason is one of the classic personal finance books. It was originally published in 1926 but there’s a reason why this book still is so often recommended to those who want to better their personal finances. The principles taught in the book are timeless and are still relevant today as they were when it was written. The book is actually written as if it were told by a group of individual authors in the city of Babylon during Biblical times, showing that even 3000 years ago the principles were tried and true.

This book tells various stories each explaining different financial principles, but the most memorable for me comes from the first story as Clason teaches 7 simple rules of money:

- Start thy purse to fattening: save money.

- Control thy expenditures: don’t spend more than you need.

- Make thy gold multiply: invest wisely.

- Guard thy treasures from loss: avoid investments that sound too good to be true.

- Make of thy dwelling a profitable investment: own your home.

- Ensure a future income: protect yourself with life insurance.

- Improve thy ability to earn: strive to become wiser and more knowledgeable.

5. “Unshakeable: Your Financial Freedom Playbook” by Tony Robbins

Most people will tell you that one of the very difficult things in investing is not letting your emotions get the best of you and this book by Tony Robbins is dedicated to ensuring you are “unshakeable” in all of your investing pursuits. Robbins teaches important principles of lowering risk while still targeting great gains and how to keep your cool no matter what happens in the market.

One of the most important takeaways I took from this book is the importance of investing in low-cost index funds, namely the S&P 500 index fund, which tracks 500 of the top US companies. Investing in the S&P 500 index fund regularly basically ensures optimal gains with minimal risk over the long run. Robbins actually shares an example of a challenge Warren Buffet gave to a few seasoned investors, where he bet $1 million that over the course of 10 years, none of them could consistently beat the S&P 500 index. Buffett was right.

Whether you’re new to investing or are more well-seasoned, I think this book will serve you well in teaching some of the important fundamentals of investing.

6. “The Intelligent Investor” by Benjamin Graham and Jason Zweig.

What to learn how to take stock investing to the next level? “The Intelligent Investor” by Benjamin Graham and Jason Zweig is one of the best ones out there. In fact, this book is where the legendary investor Warren Buffet first picked up his investing knowledge from. This is another book that was written decades ago as its first publication dating back to 1949, but once again, that doesn’t make the principles in this book any less true. The fundamentals of value-based stock investing are still very much the same now as they were then.

In this book, you’ll learn a lot of practical knowledge like, what are the most important financial metrics of a healthy company, what makes a good, diversified sampling of stocks, what effect inflation has on the stock market, and so forth. While this one may be difficult for someone who hasn’t had much exposure to investing before, I think if you stick through it you’ll feel much more confident as a stock investor.

7. “The 4-Hour Workweek” by Tim Ferriss

I remember first coming across the title of “The 4-Hour Workweek” and immediately brushing it off, thinking that it was just another one of those “too-good-to-be-true” money-management books. However, as time went on, the more I heard more about the book and its popularity. So I figured I’d give it a try. The book ended up being much more practical than I originally thought. In it, Ferriss outlines various ways to automate and streamline different things in your life so you can free up time for the things that are more important to you.

Throughout the book, Ferriss refers to The New Rich (NR), which are people who are able to abandon the conventional career plan and shift toward a more flexible and luxurious lifestyle. He argues that most people don’t necessarily want to be millionaires, but rather want the freedom it allows. This book definitely shifted my thoughts on the conventional 9-5 workweek and Ferriss really goes into very specific detail on how to really work smarter and not harder.

In reading this book you’ll cover four main areas that, when followed, will help you “reinvent yourself.” These areas are definition, elimination, automation, and liberation.

8. “The Automatic Millionaire” by David Bach

With a book title of “The Automatic Millionaire”, it might suggest becoming a millionaire is easy. Right? Well, the author David Bach argues that with the right tactics and strategies it might be easier than you think. Don’t worry. This is not another one of those “get rich quick” schemes. Bach makes it very clear that becoming a millionaire is not something that happens overnight. It takes consistent execution on key principles that will make you a millionaire. Bach’s emphasis in this book is that many of these key financial principles can be automated, which in turn makes becoming a millionaire easier.

One of the most memorable ideas for me in this book is what Bach calls the Latte Factor, which are non-necessities you commonly buy that add up over time. Avoiding these types of purchases will help you save big in the long run. For example, if each day you put the equivalent of one $3.50 latte into an investment account that nets 10% a year, on average you’d have $210,000 after 30 years, and $565,000 after 40 years.

Other key principles Bach mentions are to:

- Pay yourself first – Meaning take a set amount from each paycheck and put it into your savings. Bach’s recommendation is 10-20%.

- Accelerate your mortgage payments and achieve no-debt homeownership.

- Create automatic systems that build wealth. For example, payroll or automatic deductions so you don’t have to rely on willpower.

9. “Rich Dad’s CASHFLOW Quadrant” by Robert T. Kiyosaki

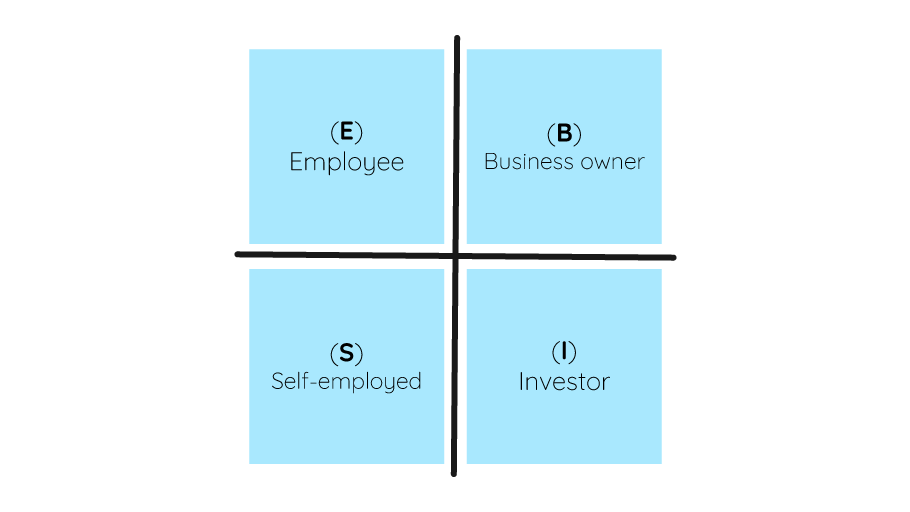

There’s a reason why I’ve included another one of Kiyosaki’s books here because, once again, he does an incredible job teaching principles in a very easy-to-understand kind of way. In this book, as the title suggests, he focuses on income/cash flow and discusses a framework of ideas on how to increase your cash flow. This framework/model includes 4 square quadrants, each being a different way people bring in money. The four cash flow quadrants are as follows:

Kiyosaki makes a point that with each of these vehicles of income getting rich is possible, but some of them require more work in order to build wealth while others allow for greater earning potential with less work. As you might have guessed, the employee or self-employed person spends a great deal of time working for their wealth, while the business owner and investor have the luxury of being able to work less but potentially earn much more.

You may wonder, “what’s the difference between a self-employed person and a business owner?” The distinction between the two is that being self-employed requires much of your time and energy while the business owner is one who is able to gather a group of capable people to do all of that for you. Being a business owner requires leadership skills and being able to create a working system.

Throughout this book, Kiyosaki urges all to make the shift from employee to business owner/investor. I’m sure you too have experienced the hard reality that employees and the self-employed face—they don’t make the amount of money their work deserves.

10. MONEY Master the Game: 7 Simple Steps to Financial Freedom by Tony Robbins

We’re at the end of the list and I have saved what I think is the best for last. I had heard about this book while reading Tony Robbin’s book “Unshakeable,” but I shied away from it when I saw how long it was. This book is a large 640-page book, or if you’re listening to the audiobook, it’s a whopping 21 hours. Initially, I feel it was worth it to dedicate that much time to a single book, but as I read through it I was reassured that my time was very well invested.

Robbin’s goal for this book is to teach the everyday person sound investing principles to enable an eventual lifetime income stream. In preparation for this book, Robbins had the opportunity to interview some of the most intelligent and successful financial wizards of our day and consolidated much of what they said into a simplified, easy(er) to understand framework. Since Robbins really touches on a wide range of topics within finance and investing, it’s hard to fit everything in a book summary, but below are what I feel are the key points of the book:

- The importance of asset allocation. Most of these top financial investors Robbins interviewed talked about asset allocation in one form or another and about its importance. He even gives a few specific asset allocation strategies that these investors recommend that the everyday investor can use to better build their own investment portfolios.

- One key principle that was discussed many times throughout the book is what’s called asymmetric risk/reward. This basically means taking on investments that have much lower risk all the while still having great potential gains. You might think that the most intelligent and successful investors have a high tolerance for risk, but it seems the opposite. All are very aware and weary of taking on too much risk. Warren Buffet said it best when he gave his “2 rules of Investing,” which are, (1) Don’t lose money, and (2) see rule number one.

- Robbins really gives some compelling evidence to avoid mutual funds and replace them with broad market index funds. He shares that no matter the rating of the mutual fund, the data shows that 96% of all active mutual funds don’t beat the market over any sustained period of time. Not only that but they have large fees that really minimize the gains you do get with them.

Looking to set some financial goals?

Start setting more effective, data-driven goals with the brightyear.io app today!

Get started

[…] some books on personal finance. There are a lot of great ones out there. Here’s a list of a few I […]